Your Trusted Partner for Comprehensive Business and Tax Services

We've merged the expertise of multiple specialized firms to offer you comprehensive business solutions, from formation to ongoing compliance and growth.

Schedule a Zoom

Appt.

We are happy to meet with you digitally. Click below to schedule an appt.

Schedule an In-Person Appt.

We’re here to help. Let’s talk. Click below to schedule an appt.

Self-Employment

Form

Learn about self-employment d

eductions, download the form below.

File an Extension

Need a little more time to finish up your tax return? Click below to download Extension Form 4868.

Call Us

Need more Information about our Services? Please, call us we will clarify all your doubts.

Expert Tax Preparation Services

Ensure your taxes are filed accurately and on time with our professional tax preparation services. Our experienced team meticulously handles every detail, maximizing your deductions and minimizing your liabilities. Let us take the stress out of tax season, so you can focus on what truly matters.

-Individual Tax Returns

-Business Tax Returns

-Tax Planning

-IRS Representation

Premium California Corporate Package

-Professional

-Non Profit

-General Law - other than professional and non profit

Our California Premium LLC package includes the following;

Preparation and filing of articles of incorporation with the California Secretary of State office

State filing fees

Organizational Meeting Minutes and Bylaws

Complete IRS Form 2553 S Corporation Election

Prepare IRS Form SS4 and obtain Employer Identification Number

Prepare and file the initial statement of information

Custom printed corporate binder, stock certificates, and corporate seal

Registered Agent Service for 1 year

Premium California Limited Liability Company

-One manager

-More than one manager

-All LLC Member (s)

Our California Premium Limited Liability Company package includes the following;

Prepare and file articles of organization with

Secretary of State

State filing fees

Operating Agreement

Employment Identification Number

LLC Binder with 25 ownership certificates and LLC Embosser Seal

Prepare and file a statement of information

Registered Agent Service for 1 year

DBA Filings

Bring your business to life with a professional "Doing Business As" name.

Prepare FBN forms

Mail to you for Signature with stamped envelope to mail back to us

File within 24 hours of receipt

4 week publication

Filing fees 1 business name

Meeting Minutes

The easiest, most flexible way to launch your business with liability protection.

-Prepare Annual Board of Directors Meeting Minutes

-Prepare Annual Shareholder Meeting Minutes

-Prepare and File Statement of Information with

-Secretary of State

Keep your financial records organized and compliant with professional bookkeeping.

- Monthly Bookkeeping

- Financial Reports

- Expense Tracking

- Quickbooks Setup and Maintenance

PAYROLL

Whether you’re paying just yourself or a staff of dozens, we’re here to help. We’re on top of payroll tax regulations—so you don’t have to be.

Who has time to stay on top of tax rules when you’re running a business? We’ll calculate, file, and pay your payroll taxes, and create, send, and file W-2s and 1099s.

We also take care of:

Automatic electronic filings and deposits

Compliance with federal, state, and local regulations

Responding to payroll-related requests from the IRS

Form LLC

Get all required licenses and permits to operate your business legally.

- Business License

- Sellers Permit

- Compliance Support

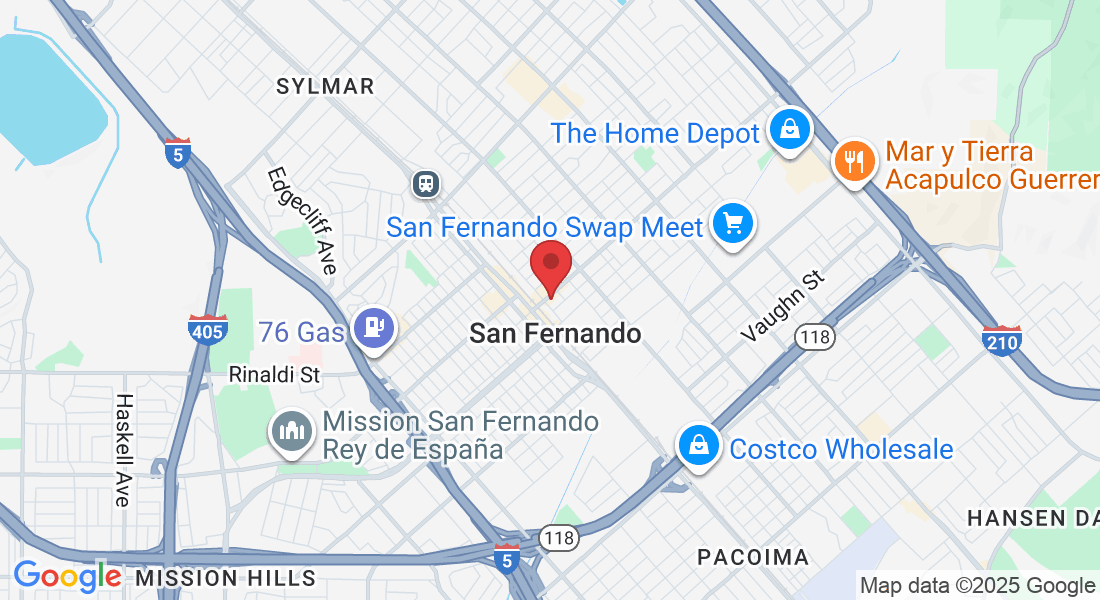

Offering Tax Services For The Following Areas:

Pacoima

Sylmar

San Fernando

Van Nuys

Panorama City

Granada Hills

North Hills

Mission Hills

Arleta

Lake View Terrace

Check Refunds Status

Why Choose Hector The Tax Guy?

We combine decades of experience with modern efficiency to deliver exceptional business services tailored to your needs.

LICENSED & BONDED: Fully licensed with CTEC, IRS authorized E-File provider, and fully bonded for your protection.

PERSONALIZED SERVICE: Direct access to experienced professionals who understand your business needs.

CONVENIENT HOURS: Open Monday-Friday 9AM-7PM, Saturday by appointment to fit your schedule.

Additional Professional Services

Complete business support services to keep your company

compliant and growing.

NOTARY SERVICES: Professional notary services for all your business and personal document needs.

• California All-Purpose Acknowledgments

• Jurats, Oaths & Affidavits

• Loan Document Signing

Business Mail Services: Professional business address services to protect your privacy and enhance credibility.

- Mail Receiving & Forwarding

• Professional Business Address

• Privacy Protection

Pension Programs: Retirement planning and pension program setup for business owners and employees.

• Retirement Plan Setup

• Employee Benefits

• Tax-Advantaged Savings

FAQS

How can I file my taxes with HectorTheTaxGuy?

Filing your taxes with HectorTheTaxGuy is easy and convenient. Simply visit our website and create an account if you haven't already. From there, you can access our user-friendly online platform, where you'll be guided through the tax filing process step by step. Our platform is designed to make it as straightforward as possible, and if you ever have questions or need assistance, our expert team is just a message or a phone call away. We're here to support you throughout the entire process.

What documents do I need to provide for tax preparation?

To prepare your taxes accurately, we need various documents, including W-2s, 1099s, receipts for deductible expenses, mortgage interest statements, and records of other income or investments. Please also bring your previous year's tax return for reference.

How can I be sure my tax return is accurate?

Our team of experienced professionals follows meticulous procedures to ensure accuracy. We stay updated with the latest tax laws and double-check every return. Additionally, our services include a review process to catch any potential errors before submission.

What should I do if I receive a tax audit notice?

If you receive a tax audit notice, contact us immediately. Our experts will guide you through the process, help you understand the notice, and represent you during the audit to ensure your interests are protected.

How can tax planning benefit me or my business?

Tax planning helps you make informed financial decisions throughout the year, potentially reducing your tax liability and maximizing savings. Our personalized tax planning services ensure that you take advantage of all available deductions, credits, and strategies tailored to your unique situation.

Can you help me if I need an extension to file my taxes?

Absolutely. We offer hassle-free tax extension services to ensure you meet IRS deadlines. We handle all the necessary paperwork and submit your extension request, giving you extra time to prepare your tax return accurately and avoid penalties.

Ready to Get Started

Email: [email protected]

Address : 110 N Maclay Ave. Suite 112, San Fernando California 91340

Phone : (818) 361-3525

Operating Hours:

Mon – Thursday 9:00am - 7:00pm

Friday - 10:00AM - 6:00PM

Saturday 10:00AM -3:00PM

Sunday – CLOSED

© 2025 Incorporate LA Inc | All rights reserved.